Table Of Content

The most important thing is to make a budget and try to stay within your means. CNET’s mortgage calculator below can help homebuyers prepare for monthly mortgage payments. While it’s important to monitor mortgage rates if you’re shopping for a home, remember that no one has a crystal ball. It’s impossible to time the mortgage market, and rates will always have some level of volatility because so many factors are at play.

MORTGAGE LENDERS

That’s tough to say—it depends on the path of inflation and the overall economy. Compare a variety of mortgage types by selecting one or more of the following. Pre-approval also gives you a big advantage when you're house-hunting. In a competitive market, you may need to make an offer fast, and if you don't have a pre-approval letter, you may lose out to another buyer who does. Sellers want the peace of mind of accepting an offer from a buyer who can prove they are qualified. We love helping people understand how rates work and what yours could be.

What Are Today’s Mortgage Rates?

Historical mortgage rate trends - CNN Underscored

Historical mortgage rate trends.

Posted: Wed, 17 Jan 2024 08:00:00 GMT [source]

So, our near record low mortgage rates are directly tied to the Federal Reserve Board's response to COVID-19 in efforts to keep financial markets open. When it begins to taper (stop purchasing 10-year Treasury notes) significantly, mortgage rates will rise. Following the COVID-19 pandemic, the Fed implemented an expansionary monetary policy to help the economy, resulting in great rates for homeowners. If a homeowner has not taken advantage of the great rates in the last two years, they should refinance as soon as possible to try to lock in a lower rate. In fact, due to the increase in inflation, the Fed has signaled that it will increase short-term rates and reduce the QE programs, resulting in higher rates for refinancing. Monetary policy is one of the most important drivers of mortgage rates.

Increase your down payment

"We got great, attentive service, and importantly, a very competitive rate that we were happy with." "was easy to upload documentation, i got a great rate, and am extremely happy with the service." Individuals should begin their mortgage search before they begin their home search. This will put them at the price point they can best afford and allow them to potentially prioritize their offer with sellers over other buyers, since they will be ready to close quickly. In this example, if your budget is $2,000 per month and rates rise to 9%, you might have to shop for a home with a lower price tag.

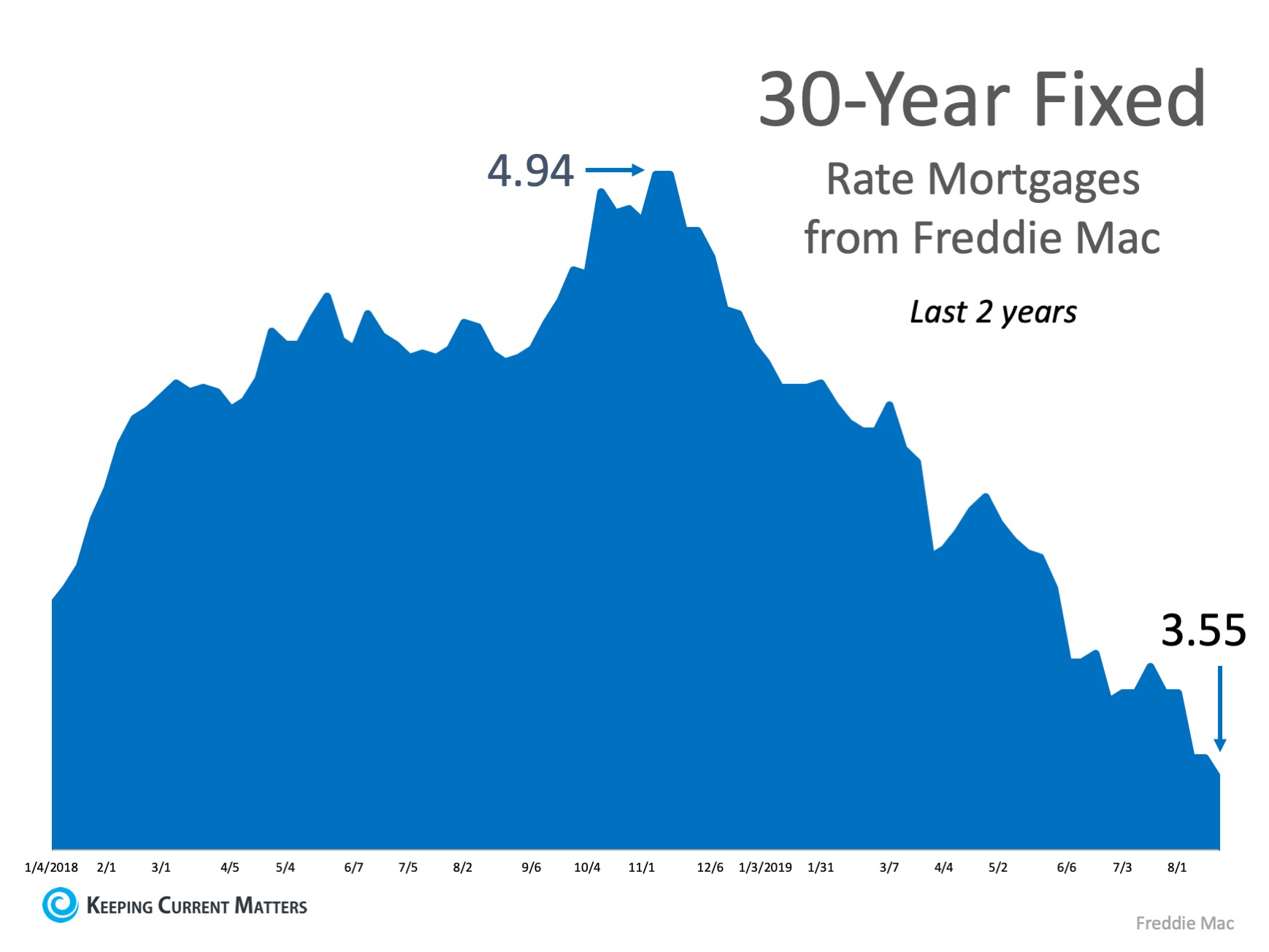

Adjust the graph below to see 30-year mortgage rate trends tailored to your loan program, credit score, down payment and location. Refinancing at lower rates is always a good idea as long as the homeowner plans on staying in the home long enough to justify the closing costs of the loan. If the current rate is significantly lower than the original, the homeowner might consider shortening the new loan’s maturity.

How to Get the Best Mortgage Rate

Three days before closing, your lender must provide you with a closing disclosure. Carefully review this disclosure to compare your final terms and costs to the terms offered in your loan estimate. The closing disclosure will state your exact monthly mortgage payment and your closing costs. If you have any questions or concerns, ask your lender before heading to the closing table.

That’s gradually changing, thanks to the Fed’s attempt to combat inflation with repeated interest rate hikes. The gap that has jumped open between these two lines has created a nationwide lock-in effect — paralyzing people in homes they may wish to leave — on a scale not seen in decades. For homeowners not looking to move anytime soon, the low rates they secured during the pandemic will benefit them for years to come.

What are APR and points?

Why some experts say you shouldn't wait for mortgage rates to fall - CBS News

Why some experts say you shouldn't wait for mortgage rates to fall.

Posted: Mon, 12 Feb 2024 08:00:00 GMT [source]

Since mortgage rates fluctuate for many reasons -- supply, demand, inflation, monetary policy and jobs data -- homebuyers won’t see lower rates overnight, and it’s unlikely they’ll find rates in the 2% range again. The rates shown above are the current rates for the purchase of a single-family primary residence based on a 45-day lock period. Your final rate will depend on various factors including loan product, loan size, credit profile, property value, geographic location, occupancy and other factors. Learn more about 30-year fixed mortgage rates, and compare to a variety of other loan types. However, the total amount of interest you pay on a 15‑year fixed-rate loan will be significantly lower than what you’d pay with a 30‑year fixed-rate mortgage. The rate and monthly payments displayed in this section are for informational purposes only.

The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms to find the product that’s right for you. While mortgage rates change daily, it’s unlikely we’ll see rates back at 3 percent anytime soon.

The average 15-year fixed-mortgage rate is 6.74 percent, up 20 basis points over the last week. Some forecasters are backing off from the earlier expectation of lower mortgage rates this year. Fixed mortgage rates follow the 10-year Treasury yield, which moves as investor appetite fluctuates with the state of the economy, inflation and Federal Reserve decisions. Interest rates on mortgages fluctuate all the time, but a rate lock allows you to lock in your current rate for a set amount of time. This ensures you get the rate you want as you complete the homebuying process.

Mortgage rates rose throughout 2023 but are expected to drop in 2024. The Federal Reserve, which hiked rates throughout much of 2022 and 2023, has indicated it will begin cutting rates in 2024 amid falling inflation and a slowing economy. The current average is 0.25% APY for a high-yield account with a $25,000 minimum deposit. On high-yield accounts requiring a minimum deposit of $10,000, today’s best interest rate is 5.35%. As a borrower, you could be quoted a higher or lower rate than the trend based on your own financial profile.

No comments:

Post a Comment