Table Of Content

But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation. Use the loan amount printed on your preapproval letter as a guide for your house-hunting journey, but avoid borrowing the maximum. Our mortgage calculator can help you determine whether your mortgage payment leaves enough room in your budget to comfortably cover your other monthly bills. The average 15-year fixed mortgage APR is 6.83%, according to Bankrate's latest survey of the nation's largest mortgage lenders.

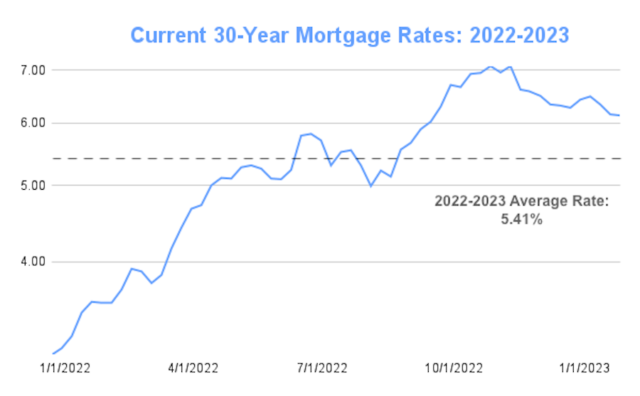

year mortgage rate increases, +0.24%

On the other hand, data that signals upside risk to inflation may result in higher rates,” Kushi said. The average rate on a 5/1 adjustable rate mortgage is 6.68 percent, rising 10 basis points since the same time last week. National mortgage rates edged higher for all types of loans compared to a week ago, according to data compiled by Bankrate. Rates for 30-year fixed, 15-year fixed, 5/1 ARMs and jumbo loans jumped.

Calculate your monthly mortgage payment

For example, on a 30-year mortgage for a home valued at $300,000 with a 20% down payment and an interest rate of 3.75%, the monthly payments would be about $1,111 (not including taxes and insurance). Because the mortgage is fixed, the interest rate of 3.75% (and the monthly payment) will stay the same for the life of the loan. Most lenders offer several mortgage rates, depending on what your score is. Every lender decides what credit score will qualify for their lowest rate, but it's typically around 740. If your score isn't quite that high, you could still qualify for a good rate -- shop around with lenders to see. Adjust the graph below to see historical mortgage rates tailored to your loan program, credit score, down payment and location.

Mortgage Rates Today: April 24, 2024—Rates Remain Fairly Steady

The trade-off is that you'll have a higher rate than you would with shorter terms or adjustable rates. The average rate for a 15-year, fixed mortgage is 6.76%, which is an increase of 12 basis points from seven days ago. Though you’ll have a bigger monthly payment than a 30-year fixed mortgage, a 15-year loan usually comes with a lower interest rate, allowing you to pay less interest in the long run and pay off your mortgage sooner. The average 30-year fixed mortgage interest rate is 7.30%, which is an increase of 18 basis points from one week ago.

Adjustable-rate mortgages are typically cheaper than fixed-rate mortgages during the first few years, but have the potential to cost you a lot more in the long run. Bankrate is an independent, advertising-supported publisher and comparison service. We arecompensatedin exchange for placement of sponsored products and services, or when you click on certain links posted on our site. However, this compensation in no way affects Bankrate’s news coverage, recommendations or advice as we adhere to stricteditorial guidelines. Bankrate has helped people make smarter financial decisions for 40+ years.

The cost can vary depending on many factors, including your lender and how much you’re borrowing. It’s possible to get the seller or lender to pay a portion or all of these costs. Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

year fixed-rate

The average 30-year fixed-refinance rate is 7.30 percent, up 23 basis points over the last seven days. A month ago, the average rate on a 30-year fixed refinance was lower at 6.91 percent. The average rate you'll pay for a 30-year fixed mortgage today is 7.29 percent, up 24 basis points over the last seven days. Last month on the 22nd, the average rate on a 30-year fixed mortgage was lower, at 6.97 percent. If you’re trying to find the right mortgage rate, consider using Credible. You can use Credible's free online tool to easily compare multiple lenders and see prequalified rates in just a few minutes.

Mortgage rate locks usually last between 30 and 60 days, and they exist to give you a guarantee that the rate your lender offered you will still be available when you actually close on the loan. If your loan doesn’t close before your rate lock expires, you should expect to pay a rate lock extension fee. The Fed’s economic projections indicate the federal funds rate will remain higher through 2025 and in the longer run than previously expected.

Pressley Urges Powell to Cut Interest Rates to Boost Housing, Home Affordability - Representative Ayanna Pressley

Pressley Urges Powell to Cut Interest Rates to Boost Housing, Home Affordability.

Posted: Wed, 06 Mar 2024 08:00:00 GMT [source]

Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you don’t have to drive to an office or branch location. Additionally, applying for multiple mortgages in a short period of time won’t show up on your credit report as it’s usually counted as one query. Though lenders decide your mortgage rate, there are some proactive steps you can take to ensure the best rate possible. For example, advanced preparation and meeting with multiple lenders can go a long way. Even lowering your rate by a few basis points can save you money in the long run. Lauren Graves is an educator-turned-editor specializing in personal finance content.

There are thousands of state and local homebuyer programs that can help first-time buyers afford a home. Often they partner with lenders that are certified to offer the program and have experience working with first-time homebuyers. Local nonprofits that help lower-income buyers frequently have lenders in their network also.

I’ve had a front-row seat for two housing booms and a housing bust. I’ve twice won gold awards from the National Association of Real Estate Editors, and since 2017 I’ve served on the nonprofit’s board of directors. On Sunday, April 28, 2024, the national average 30-year fixed mortgage APR is 7.37%. The average 30-year fixed refinance APR is 7.37%, according to Bankrate's latest survey of the nation's largest mortgage lenders. This table does not include all companies or all available products. Our advertisers do not compensate us for favorable reviews or recommendations.

An amount paid to the lender, typically at closing, in order to lower the interest rate. One point equals one percent of the loan amount (for example, 2 points on a $100,000 mortgage would equal $2,000). Closing costs are the fees you, as the buyer, need to pay before getting a loan.

Once you find a rate that is an ideal fit for your budget, it’s best to lock in the rate as soon as possible, especially when mortgage rates are predicted to increase. While it’s not certain whether a rate will go up or down between weeks, it can sometimes take several weeks to months to close your loan. For homeowners looking to leverage their home's value to cover a big purchase — such as a home renovation — a home equity line of credit (HELOC) may be a good option while we wait for mortgage rates to ease. Check out some of our best HELOC lenders to start your search for the right loan for you.

Fixed-rate mortgages keep the same interest rate throughout the term; with adjustable-rate mortgages, interest rate changes over time can make monthly payments go up or down. Use our free mortgage calculator to see how today's mortgage rates would impact your monthly payments. By plugging in different rates and term lengths, you'll also understand how much you'll pay over the entire length of your mortgage. Though mortgage rates and home prices are high, the housing market won’t be unaffordable forever. It’s always a good time to save for a down payment and improve your credit score to help you secure a competitive mortgage rate when the time is right.

No comments:

Post a Comment